The Best Guide To Clark Wealth Partners

Clark Wealth Partners Can Be Fun For Everyone

Table of ContentsUnknown Facts About Clark Wealth PartnersThe Of Clark Wealth PartnersClark Wealth Partners Can Be Fun For AnyoneSee This Report about Clark Wealth PartnersWhat Does Clark Wealth Partners Mean?

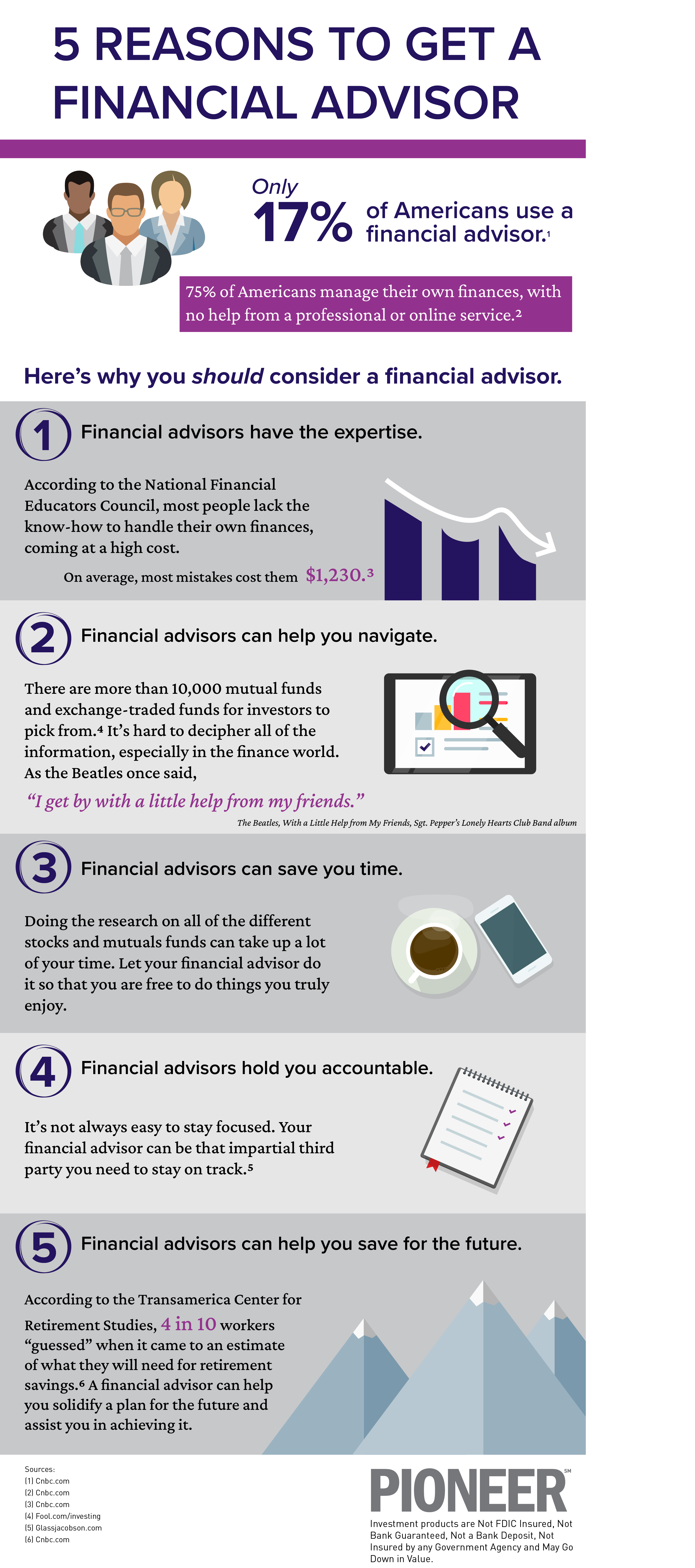

Just put, Financial Advisors can handle part of the obligation of rowing the boat that is your financial future. A Financial Advisor should deal with you, except you. In doing so, they must act as a Fiduciary by putting the very best interests of their customers over their own and acting in great confidence while giving all pertinent truths and avoiding problems of interest.Not all partnerships are effective ones. Prospective downsides of working with a Monetary Expert include costs/fees, top quality, and potential desertion.

Disadvantages: Top Quality Not all Monetary Advisors are equal. Just as, not one consultant is ideal for every prospective client.

See This Report on Clark Wealth Partners

A customer should always be able to respond to "what occurs if something takes place to my Financial Advisor?". Always appropriately vet any kind of Financial Consultant you are considering functioning with.

If a specific location of knowledge is needed, such as functioning with exec compensation plans or setting up retirement strategies for small service proprietors, find consultants to meeting that have experience in those arenas. Working with an Economic Advisor ought to be a collaboration.

It is this kind of effort, both at the begin and through the relationship, which will aid emphasize the benefits and hopefully minimize the downsides. The duty of a Financial Advisor is to help clients establish a strategy to fulfill the financial objectives.

That job consists of charges, in some cases in the forms of property administration costs, compensations, planning charges, investment item fees, etc - Tax planning in ofallon il. It is very important to recognize all charges and the framework in which the advisor operates. This is both the duty of the advisor and the customer. The Financial Expert is accountable for giving value for the charges.

The Ultimate Guide To Clark Wealth Partners

Preparation A service plan is crucial to the success of your organization. You need it to know where you're going, exactly how you're getting there, and what to do if there are bumps in the road. An excellent monetary advisor can place together a thorough plan to aid you run your company extra effectively and plan for anomalies that emerge.

Reduced Stress As an organization owner, you have lots of points to fret around. A great financial consultant can bring you peace of mind knowing that your funds are obtaining the attention they require and your money is being invested intelligently.

Often company proprietors are so concentrated on the everyday work that they shed sight of the huge picture, which is to make a revenue. An economic advisor will look at the general state of your finances without getting feelings included.

Little Known Facts About Clark Wealth Partners.

There are lots of pros and cons to think about when working with a financial consultant. Advisors deal personalized techniques customized to specific goals, potentially leading to much better economic end results.

The price of hiring a financial advisor can be significant, with fees that may affect general returns. Financial planning can be overwhelming. We suggest speaking with a monetary consultant.

It only takes a few minutes. Have a look at the experts' accounts, have an initial contact the phone or intro personally, and select who to deal with. Locate Your Expert Individuals turn to financial consultants for a myriad of reasons. The possible advantages of working with an expert include the proficiency and knowledge they supply, the personalized advice they can provide and the lasting self-control they can inject.

The 5-Minute Rule for Clark Wealth Partners

Advisors learn specialists that stay updated on market fads, financial investment methods and economic policies. This understanding allows them to offer insights that could not be conveniently obvious to the typical individual - https://securecc.smartinsight.co/profile/14822598/ClarkWealthPartners. Their know-how can aid you browse complicated monetary circumstances, make informed decisions and possibly exceed what you would certainly complete on your very own